California 4-hour Suitability and Best Interest in Annuity Transactions Training and Continuing Education

.png?sfvrsn=a8dded63_0)

California 4-hour Suitability and Best Interest in Annuity Transactions

This course is approved to meet California’s 2025 requirement for 4 hours of ongoing annuity suitability and best interest training. Life producers transacting annuity business must complete this training before each license renewal.

RETAIL PACKAGES STARTING AT*

$16.95

or as part of

the All Access Continuing Education Library*:

$49.95

Course Overview

Who is required to take this course?

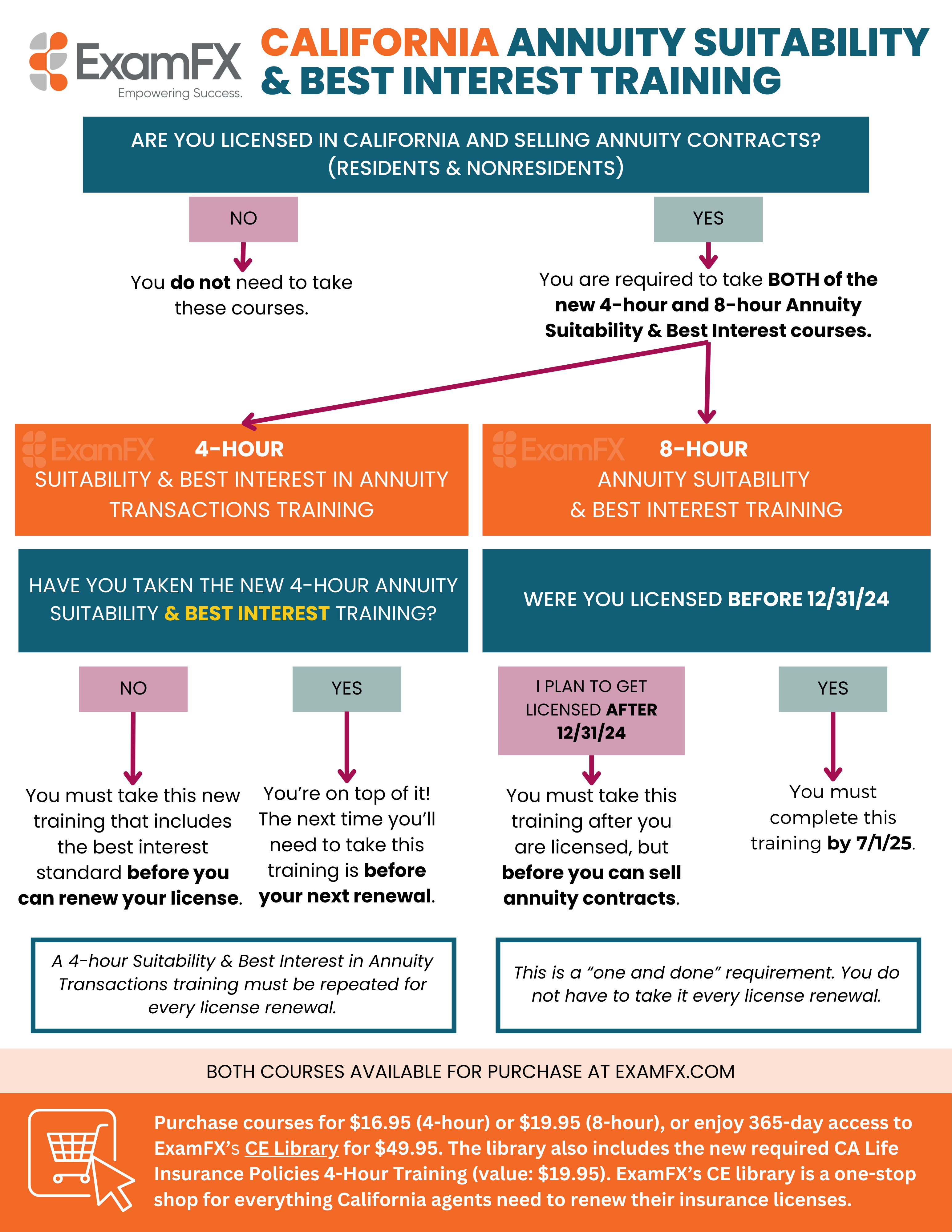

Additional annuity suitability with “best interest” standard training is required for California Life Producers selling annuity contracts.

- Beginning in January 2025, resident and nonresident licensees selling annuities, regardless of when they were originally licensed, must complete an approved 8-hour Annuity Suitability and Best Interest training course before July 1, 2025.

- Resident and nonresident licensees selling annuity contracts must complete an approved 4-hour Suitability and Best Interest in Annuity Transactions training before every license renewal.

- All newly licensed Life and Life and Health producers will need to complete an approved 8-hour Annuity Suitability and Best Interest training course before transacting annuity business.

Understand which Suitability and Best Interest Training Requirements you need to fulfill.

This 4-hour course covers:

- Information required to be included, types of statements that may not be used, and inappropriate advertisements when advertising annuity products to persons 65 years or older;

- Prohibited sales practices for annuities;

- “Unnecessary replacement” and the requirements for in-home solicitations of annuity products;

- Medi-Cal requirements regarding annuity suitability transactions;

- Causes for license suspension and penalties in annuity product sales;

- Ethical responsibilities of the licensee and insurance company when selling annuities

RETAIL PACKAGES STARTING AT*

$16.95

Or as part of the All Access Continuing Education Library*: $49.95

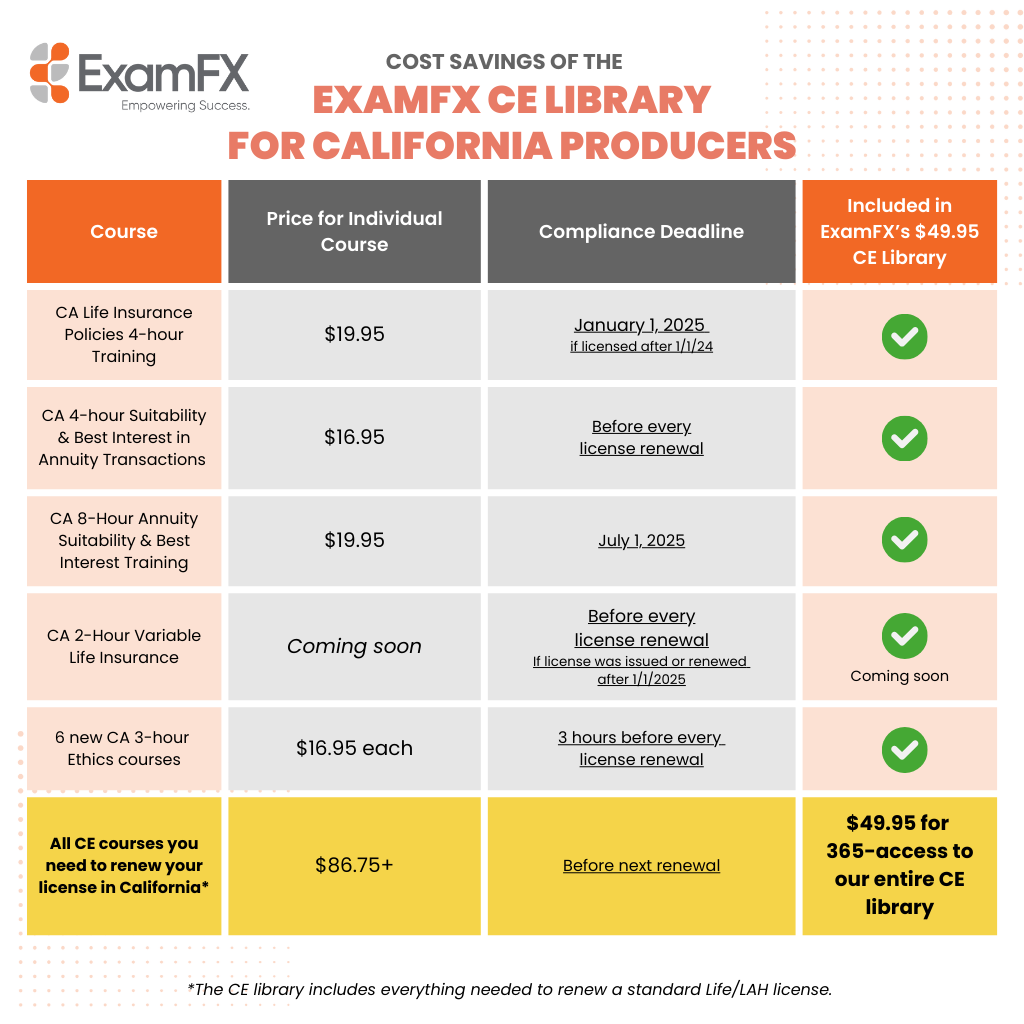

* For the best bang for your buck, consider purchasing the All Access Continuing Education Library to get automatic access to all of the courses that will help you meet your CE requirement in the state of California.

- Includes a complete collection of courses needed to renew a Life/Life and Health license.*

- Library updates automatically if requirements change.

- 365-day access to more than 20 state-specific online courses producers can use towards license renewal.

- Includes the California Life Insurance Policies 4-Hour Training, this newly required 4-hour Suitability and Best Interest in Annuity Transactions course, plus the 8-hour Annuity Suitability and Best Interest Training course, which will automatically be added to your CA All-Access Library.

Understand this new requirement and how it affects you

Watch this webinar recording, hosted by Cynthia Davidson, our Director of Insurance, Content and Compliance. You’ll get a detailed explanation of the regulation, its implications, and what it means for you.

Watch Webinar Recording

California Annuity & Best Interest Training Deep Dive - On Demand Webinar

Continuing Education Individual Courses

Our individual CE courses are designed to service your CE needs. Perfect for self-motivated learners - Study 24/7 with our Interactive Learning Portal, access streamlined exam-specific content and reinforce your new knowledge through multiple quizzes and simulated exams.

KEY INSURANCE CONTINUING EDUCATION FEATURES INCLUDE:

View available CE courses and your state's requirements

Your first step for success is to understand your specific state's continuing education requirements for maintaining your insurance license. To see your state's specific available courses and requirements, please follow the link below. You will also find helpful information that you need to know.

VIEW CALIFORNIA CE REQUIREMENTS

About ExamFX's Insurance Continuing Education Library

CONTINUING EDUCATION COURSE DESCRIPTIONS

ExamFX offers a library of online Continuing Education courses designed to meet your license renewal requirements while enhancing professional development and expanding your knowledge.

Anti-Money Laundering - Ethical Decision Making For Insurance Producers - 3 Hours*

To that end, producers will study various anti-money laundering laws that have been enacted, steps in money laundering, and red flags that may crop up during business that may lead them to suspect money laundering.

Producers will also look at the reports a company may need to file (Suspicious Activity Reports) and statistics regarding the types of reported suspicious activities. They will also learn about Specially Designated Nationals, individuals or companies whose assets are blocked and with whom U.S. persons are generally prohibited from dealing.

Learning Objectives

The purpose of this course is to educate the producer on their responsibilities as they relate to the USA PATRIOT Act. Upon completion of this course, a producer will be able to:

- Explain the 3 phases of money laundering

- Identify the types of insurance products most likely to be employed in a money laundering scheme

- Explain the requirements of a Customer Identification Program

- Explain the financial services obligations to conduct due diligence and ongoing monitoring of its customers

- Explain a producer’s responsibility for reporting suspicious activity; and

- Explain the red flags of money laundering as they relate to the utilization of insurance products

Annuity Suitability and Best Interest Standard Training - 4 Hours*

This course was designed to satisfy the one-time, 4 credit-hour training course requirements imposed by the NAIC 2019 Annuity Suitability Model Act. It provides details about the “Best Interest” standard and other provisions of the Model Act. It also includes a thorough review of annuity products: types of annuities, annuity regulation, advantages and disadvantages, taxation, and replacement. Studying and contrasting various types of annuities and reviewing customer situations will improve a producer’s ability to know which annuity products and features best serve a client's financial needs.

Learning Objectives

This course explores topics with an emphasis on how they impact the sales process, the determination of suitability, and compliance with the best interest standard. Upon completion of this course, a producer will be able to identify:

- Annuity basics and terminology

- Parties to annuity contracts

- Product overview, including fixed, immediate, index and variable annuities

- Annuity taxation

- Annuity replacements and exchanges

- The licensee’s role in suitable sales

- How to apply the Best Interest Standard

Businessowners Policy (BOP) - 4 Hours*

This basic level course provides an overview of the Businessowners package policy (BOP) and guides producers in understanding how this policy is used to cover small and medium-sized business risks, including eligibility, features, coverages, exclusions, riders, etc.

Learning Objectives

Upon completion of this course, a producer will be able to:

- Understand how to apply the Businessowners Policy (BOP) to eligible business risks

- Understand how to best serve policyowners by customizing BOP coverage using riders and optional coverages

Commercial Lines: Property/Auto/Liability - 4 Hours*

This course reviews different types of commercial policies: their characteristics, coverages, and suitability.

Learning Objectives

Upon completion of this course, a producer will be able to:

- Understand the various risks faced by commercial enterprises

- Evaluate those risks specific to the client

- Understand the various insurance coverages available to address commercial risks

- Help those customers strategically minimize the risks by recommending appropriate commercial lines insurance products

Distribution Planning - 4 Hours*

This advanced-level course describes the various distribution options available to retirement plan participants, how those distribution options affect income amount and duration, tax considerations, minimum distribution requirements, and all the factors which must be considered when choosing a distribution option.

Learning Objectives

Upon completion of this course, a producer will be able to:

- Guide clients through the entire post-retirement distribution planning process

- Helping clients make critical up-front decisions with a better understanding of the income and tax ramifications of those decisions

Ethical Practices: Avoiding E&O Claims - 3 Hours*

This course reviews producer practices that can lead to errors & omissions claims. Case studies from all lines of insurance, and from all aspects of the insurance transactions from sales approach to application, to claims handling illustrate critical ethical decision points for producers, and demonstrate best practices for avoiding E&O claims.

Learning Objectives

Upon completion of this course, a producer will be able to:

- Avoid the most common oversights and violations

- Understand how to ethically serve their clients

Ethics & Insurance: How to Sell Ethically and Comply with the Law - 3 Hours*

This basic-level course is designed to fulfill the Ethics component of a producer’s continuing education requirement. It provides an overview of ethics in the insurance business, including producer responsibilities to the carrier and the consumer. Covered: field underwriting and policy delivery, fiduciary responsibilities, unfair trade practices, unfair claims practices, producer errors & omissions, consumer privacy, compliance vs. ethics. Includes relevant case studies and enforcement actions. Applicable to all lines of insurance.

Learning Objectives

Upon completion of this course, a producer will be able to:

- Understand the ethical responsibilities of insurance producers to their clients and to the insurance company

- Identify and avoid non-compliant behaviors

- Be better equipped to provide excellent, fair, and high-quality service to the insurance-buying public

Flood Insurance - 3 Hours*

In many states, producers who sell National Flood Insurance Policies are required to take a one-time 3-hour course prior to selling flood insurance. This course meets the requirements for NFIP Certification training.

Learning Objectives

Upon completion of this course, a producer will be familiar with:

- Types of flood coverage available

- NFIP program and how to submit applications

- Flood zones, maps and rating

- Handling of flood claims

- Requirements of the Flood Insurance Reform Act of 2004 (FIRA)

Front Line Fraud Prevention - 3 Hours*

This course identifies how and when fraudulent activity may infiltrate all stages of the insurance lifecycle (application, underwriting, claims) and clearly outlines the producer’s role on the “front line” in identifying insurance fraud both when soliciting new business and when servicing existing contracts. This course describes relevant state and federal laws that relate to insurance fraud and detail the rules that producers must follow in order to behave ethically and responsibility toward insurance consumers as well as to the insurance carrier.

Learning Objectives

Upon completion of this course, a producer will understand:

- How to spot patterns of suspicious consumer behavior

- The difference between behavior that is legal and ethical vs. Behavior that is legal but unethical

- What their contractual, legal and ethical responsibilities are for reporting suspected fraud to regulators, law enforcement and insurance company special investigative units

- Most common “Red Flags” that indicate an application or a claim could be fraudulent

Group Benefits and Worksite Insurance - 4 Hours*

This course offers an overview of different types of group and workplace insurance plans, including requirements for eligibility, enrollment, evidence of coverage, plan documentation, and portability/conversion.

Learning Objectives

Upon completion of this course, a producer will be able to:

- Prepare to evaluate, recommend, and properly service employee benefit plans including group life, group health and disability, long-term care, and other group plans

Health Insurance Policies: Protecting Clients from Health-Related Loss - 5 Hours*

This basic-level course details the health insurance market –underwriting, policy features, required and optional provisions, advantages, disadvantages, and available riders, for many types of health policies including individual and group policies, disability income, Medicare Supplement, Long Term Care, and specialty policies. Social insurance and workers compensation are also discussed.

Learning Objectives

Upon completion of this course, a producer will be able to:

- Have a deeper understanding of the health insurance market and the many different types of health policies available to minimize the financial risks of illness and disability

- Use this knowledge to make health insurance producers more effective at matching the right product to the health insurance needs of their customers